“He who moves not forward, goes backward.”

~ Johann Wolfgang von Goethe

It is both practically desirable and morally imperative for individuals and institutions in the so-called “developed” world to strive for a major acceleration of technological progress within the proximate future. Such technological progress can produce radical abundance and unparalleled improvements in both length and quality of life – whose possibilities Peter Diamandis and Steven Kotler outlined in their 2012 book Abundance: The Future is Better Than You Think. Moreover, major technological progress is the only way to overcome a devastating step backward in human civilization, which will occur if the protectionist tendencies and pressures of existing elites are allowed to freeze the status quo in place.

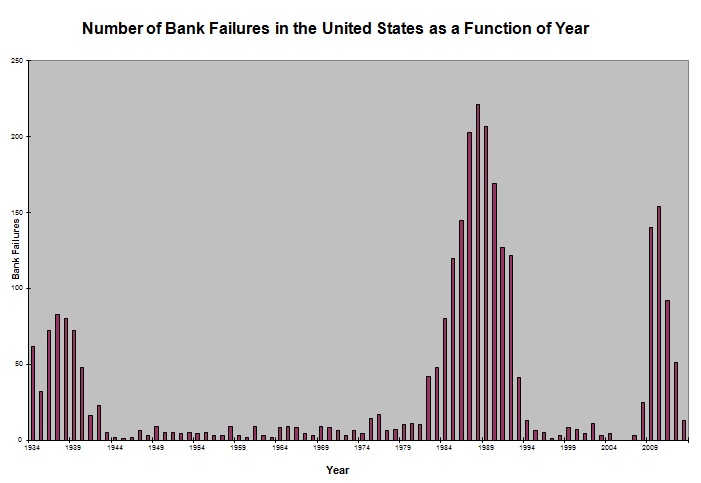

If the approximate technological and economic status quo persists, massive societal disintegration looms on the horizon. A Greece-style crisis of national-government expenditures may occur as some have predicted, but would only be a symptom of a greater problem. The fundamental driver of crisis since at least September 11, 2001, and more acutely since the Great Recession and the national-government bailouts of legacy financial and manufacturing institutions, is an increasing disconnect between the powerful and everybody else. The powerful – i.e., the politically connected, including the special interests of the “private sector” – seek to protect their positions through political barriers, at the expense of individual rights, upward social mobility, and economic/technological progress. Individuals from a relatively tiny politically connected elite caused the 2008 financial crisis, lobbied for and received unprecedented bailouts and lifelines for the firms whose misbehavior exacerbated the crisis, and then have attempted to rig the political “rules of the game” to prevent themselves from being unseated from positions of wealth and influence by the dynamics of market competition. The system created by these elites has been characterized by various observers as crony capitalism, corporatism, corporate fascism, neo-mercantilism, and a neo-Medieval guild system.

The deleterious influence of the politically connected today is reflected in the still-massive rates of unemployment and underemployment for the millennial generation, while many established industries fail to make openings for young people to ascend and fail to accommodate the emerging technologies with which young people thrive. While the millennial generation had nothing to do with the Great Recession, it has suffered its greatest fallout. Many millennials now encounter tremendous diminution in economic opportunity and living standards (think of young people in New York City paying several thousand dollars a month to share a tiny, century-old apartment among three people – or the emerging trend of shipping containers being converted into the only type of affordable housing for young people in San Francisco). The “Occupy” movement was a reflection of the resulting discontentment – a reflexive and indiscriminate backlash by young people who knew that their circumstances were unjustly bad, but did not understand the root causes or the culprits.

The only way for a crisis to be averted is for the current elites to stop blocking people from the millennial generation from opportunities to achieve upward mobility. The elite must also stop bailing out obsolete and poorly managed legacy institutions, and cease erecting protectionist barriers to the existence of innovative businesses that young people can and have tried to start. If the millennial generation continues to be shut out of the kinds of opportunities available to the preceding generation, however, I can envision two crisis scenarios. Each of these characterizations is not a prediction (but rather a nightmare which I hope can be avoided), is somewhat broad and, of course, is tentative. However, these scenarios are rough outlines of how the West could falter in the absence of significant technological progress.

Crisis Scenario 1: “Occupy” Times Ten: Millions of unemployed thirty-somethings (millennials in five to ten years) riot in the streets, indiscriminately destroying storefronts and setting cars alight. Economic activity and sophisticated production are ground to a halt because of the turmoil. The continuity of knowledge transfer and intergenerational symbiosis involved in human civilization are completely interrupted. Clashes with police create martyrs who are then invoked by opportunistic thugs as an excuse to loot and burn. Without the opportunity for peaceful economic cooperation, society degenerates into armed gangs, some left-wing (e.g., “Black Bloc” violent anarchists), others right-wing (e.g., survivalist militia groups). Thoughtful and intellectual people, who want the violence to end and see an imperfect peace as better than a war of all against all, are universally despised by the new tribes and cannot find a safe environment in which to work and innovate. The infrastructure of everyday life is critically damaged, and nobody maintains or repairs it. Roads, bridges, pipes, and electrical grids are either destroyed or become unusable after years of decay. The West becomes Ukraine writ large, eventually regressing into premodernity.

Crisis Scenario 2: The Reaction: Current political and crony-capitalist elites crack down with extreme force, either in response to actual riots or, more likely, to the threat thereof. Civil liberties are obliterated and an economic underclass enforced through deliberate restrictions on entry into any remunerative occupations – much like the 17th-century mercantilists advocated for maximum wages and prohibitions on perceived luxuries for the working classes. Those who do get jobs are required to work 60 or more hours per week and so have no time for anything else in life. All established industries are maintained in their current form through legal protections and bailouts, and there is an official policy that the structure of the economy must not be allowed to change for any reason. (Think of Directive 10-289 from Ayn Rand’s Atlas Shrugged.) Licensing requirements for professions become ubiquitous and burdensome, laden with Catch-22 provisions so that few or no new entrants can make it into the system. Only an elite cadre of Baby Boomers enjoys wealth and uses the force of legal entry barriers to prevent anyone else from having the opportunity to earn their own. They have ground technological progress to a halt, seeking to keep established business models in place and thwart all competition. The national government develops a massive spying capability and enforces social order through the ability to detect behaviors that might even be algorithmically correlated with dissent. All ordinary citizens are routinely humiliated in public under the pretense of thwarting crime or terrorism. TSA body searches have expanded beyond airports to highway checkpoints, shopping centers, and random stops by police on city streets. People’s homes are routinely raided by SWAT teams at the mildest pretext. This is done to make people meek and subservient to the established order. To keep young people from rioting (and get rid of the “excess” unemployed youths), the elites concoct jingoistic justifications to inflame endless foreign wars, and young people are conscripted and sent to die abroad. If any of these wars aggravate the regimes of either Russia or China, this scenario has the added risk of putting the world back on the verge of nuclear conflict. The fast-senescing crony-capitalist elites have cut off future biomedical progress and so will die eventually, but only the children of the elite will inherit any wealth. A neo-feudal oligarchy is established and becomes gradually ossified throughout the generations, while the industrial and technological base built over the past 200 years, as a legacy of the Enlightenment and individual rights, will deteriorate, eventually bringing the West back into premodernity.

I see an ossification of the status quo as leading to one or both of the above crisis scenarios. A return of premodernity is the logical conclusion of the dynamics of a fundamentally unaltered status quo. If humankind does not move technologically forward, it will go backward in a spiral of destruction and repression.

The only way for either crisis scenario to be averted is for technological progress to occur at no slower than the rates experienced during the twentieth century. Overt political revolution, even if it begins peacefully, is dangerous. To understand why this is so, one needs look no further than the recent Arab Spring uprisings – initially motivated by liberally minded dissidents and ordinary people who could no longer tolerate corrupt dictatorships, but ultimately hijacked by Islamist militants, military juntas, or both. A case even closer to the contemporary Western world is the recent Maidan revolution in Ukraine, which, while initially motivated by peaceful and well-intentioned pro-European activists, replaced a corrupt regime that occasionally persecuted dissidents with a fiercely militant, nationalistic regime that tolerates no dissent, engages in coercive historical revisionism, prohibits criticism of Nazi and neo-Nazi thugs, conscripts some of its citizens to die in civil war, and indiscriminately shells others of its citizens in the East. Revolutions always have the potential of replacing a lethargically bad regime with an aggressively destructive one.

This is why it is better for any societal transformation to be driven primarily by technological and economic development, rather than by political turmoil. The least turbulent transformations should be somewhat gradual and at least grudgingly accepted by the existing elites, who need to be willing to alter their own composition and accept bright minds from any background – not just their own progeny. A sufficient rate of technological advancement – especially due to the growth in 3D printing, robotics, nanotechnology, biotechnology, genetic engineering, vertical farming, and renewable energy – can ensure near-universal abundance within a generation, untethered from permission-granting institutions to which most people today owe a living. Such prosperity would enable most people to experience what are today upper-middle-class living standards, therefore having no motivation to riot. Technological progress can also preserve individual liberty by continually creating new spheres where politicians and lobbyists are incapable of control and individuals can outmaneuver most political restrictions.

Technological progress, particularly radical extension of the human lifespan through periodic rejuvenation that can restore the body to a more youthful condition, is also the only hope for remedying unsustainable expenditures of national governments, which are presently primarily intended to support people’s income and healthcare needs in old age. Rejuvenation biotechnology of the sort championed by Dr. Aubrey de Grey’s SENS Research Foundation could be developed with sufficient investment into the research, and could become disseminated by biotechnology entrepreneurs, ensuring that older people do not become decrepit or incapable of productive work as they age. The only way to sustainably extend average lifespans past about 85 years would be to turn back the clock of biological aging. It is not possible for most people (who do not have some degree of genetic luck) to live much longer beyond that without also becoming more youthful.

Many people who receive rejuvenation treatments will not want to retire – at least not from all work – if they still feel the vitality of youth. They will seek out activities to support human well-being and high living standards, even if they have saved enough money to consider it unnecessary to take a regular 8-to-5 job. With the vitality of youth combined with the experience of age, these people will be able to make sophisticated, persistent contributions to human civilization and will tend to plan for the longer term, as compared to most people today. If automation takes care of basic human needs, then human labor will be freed for more creative and fulfilling tasks.

Effective rejuvenation will not arrive right away, but immigration can keep the demographic disparity between the young and the old from being a severe problem in the meantime. This is another reason to reject protectionist policies and instead pursue approaches that allow more people to contribute to and benefit from the material prosperity of the “developed” world. Birth rates tend to fall anywhere there are major rises in standards of living after an industrial revolution, as children stop becoming productive helpers in an agricultural economy and instead become expensive to raise and educate so that they can participate in a knowledge-based economy. However, birth rates are still higher in many less-developed parts of the world, and people from those areas will readily seek opportunities for economic advancement in more developed countries, if given the option.

Fortunately, there are glimmers of hope that the path of gradual embrace of ever-accelerating progress will be the one taken in the early-21st-century Western world. The best outcome would be for an existing elite to facilitate mechanisms for its own evolution by offering people of merit but from humble backgrounds a place in real decision-making.

Some of that evolution can occur through market competition – new, upstart businesses displacing incumbents and gradually amassing significant resources themselves. The best instantiation of this in the United States today is the Silicon Valley entrepreneurial culture – which, incidentally, tends to finance the majority of longevity research. The most massive infusion of funds into longevity-related research has been from an offshoot of Google – Calico – founded in 2013 and currently partnering with a large pharmaceutical company, AbbVie. Calico has been somewhat secretive as to the details of its research, but there are other large businesses that are beginning to invest in similar endeavors – e.g., Craig Venter’s Human Longevity, Inc. Moreover, the famous libertarian venture capitalist Peter Thiel has given millions of dollars to Dr. Aubrey de Grey’s SENS Research Foundation – a smaller-scale organization but perhaps the most ambitious in its goals to bring about a reversal of human senescence through advances in rejuvenation treatments within the next quarter-century.

These developments are evidence that the United States today is characterized not by one elite, but by several – and the old “Paper Belt” elite is clearly in conflict with the new Silicon Valley elite. Politicians tend, surprisingly, not to be the most decisive players in this conflict, since they typically depend on harnessing pre-existing cultural currents in order to get elected and stay in office. Thus, they will tend to side with whatever issues and special interests they consider to be gaining ground at a given time. For this reason, many thinkers have characterized politics as a lagging indicator, responding to rather than triggering the defining events of an era. The politicians ride the currents to power, but something else creates those currents.

Differences in the breadth of vision among elites also matter. For instance, breakthroughs in human longevity could actually be a great boon for medical providers and the first pharmaceutical companies that offer effective products/treatments. Even the most ambitious proponents of life extension do not think it possible to develop a magic immortality pill. Rather, the treatments involved (which will be quite expensive at first) would require periodic regeneration of the cells and tissues within a person’s body – essentially resetting the biological clock every decade or so, while further innovation uncovers ways to reverse the damage more cheaply, safely, and effectively. This is a field ripe with opportunities for enterprising doctors, researchers, and engineers (while, at the same time, certainly endangering many extant business models). Some government officials, if they are sufficiently perceptive, could also be persuaded to support these changes – if only because they could prevent a catastrophic collapse of Social Security and Medicare. Approximately 30% of Medicare expenditures occur during the last year of patients’ lives, when the body is often fighting back multiple ailments in a losing battle. If this situation were simply prevented in the first place, and if most people became biologically young again and fully capable of working for a living or financing their own retirements, the expenses of both Social Security and Medicare could plummet until these programs became wholly unnecessary in the eyes of most voters.

The key to achieving a freer, more prosperous, and longer-lived future is to educate both elites and the general public to accurately weigh the opportunities and risks of emerging technologies. Too many individuals today, both elites and ordinary people, view technological progress with suspicion, conjuring in their minds every possible dystopian scenario and every possible malfunction, inconvenience, lost opportunity, moral reservation, or esthetic dislike they can muster against breakthroughs in life extension, artificial intelligence, robotics, autonomous vehicles, genetic engineering, nanotechnology, and many other areas of advancement that could vastly benefit us all. This techno-skeptical mindset is the biggest obstacle for proponents of progress and a better future to overcome. Fortunately, we do not need to be elites to play important roles in overcoming it. By simply arguing the techno-optimist case and educating people from all walks of life about the tremendous beneficial potential of emerging technologies, we can each do our part to ensure that the 21st century will become known as an era of humankind’s great liberation from its age-old limitations, and not a lurch back into the bog of premodern barbarism.

If we have a modicum of technological progress, the West might be able to muddle through the next several decades. If we have an acceleration of technological progress, the West will leave its current problems in the dust. The outcome will be a question of whether people (both elites and ordinary citizens) are, on balance, held hostage to the fear of the new or, rather, willing to try out technological alternatives to the status quo in the hopes of achieving improvement in their lives.

Source: OICA

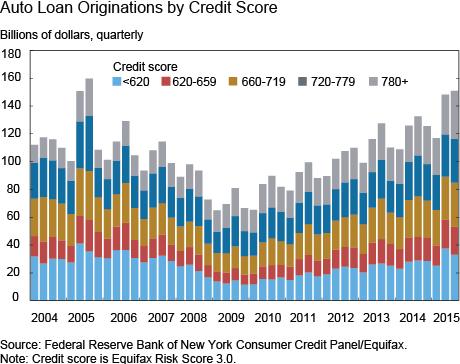

Source: OICA Source: New York Fed

Source: New York Fed