“Report Suggests Nearly Half of U.S. Jobs Are Vulnerable to Computerization,” screams a headline. The cry of “robots are coming to take our jobs!” is ringing across North America. But the concern reveals nothing so much as a fear—and misunderstanding—of the free market.

In the short term, robotics will cause some job dislocation; in the long term, labor patterns will simply shift. The use of robotics to increase productivity while decreasing costs works basically the same way as past technological advances, like the production line, have worked. Those advances improved the quality of life of billions of people and created new forms of employment that were unimaginable at the time.

Given that reality, the cry that should be heard is, “Beware of monopolies controlling technology through restrictive patents or other government-granted privilege.”

The robots are coming!

Actually, they are here already. Technological advance is an inherent aspect of a free market in which innovators seeks to produce more value at a lower cost. Entrepreneurs want a market edge. Computerization, industrial control systems, and robotics have become an integral part of that quest. Many manual jobs, such as factory-line assembly, have been phased out and replaced by others, such jobs related to technology, the Internet, and games. For a number of reasons, however, robots are poised to become villains of unemployment. Two reasons come to mind:

1. Robots are now highly developed and less expensive. Such traits make them an increasingly popular option. The Banque de Luxembourg News offered a snapshot:

The currently-estimated average unit cost of around $50,000 should certainly decrease further with the arrival of “low-cost” robots on the market. This is particularly the case for “Baxter,” the humanoid robot with evolving artificial intelligence from the US company Rethink Robotics, or “Universal 5” from the Danish company Universal Robots, priced at just $22,000 and $34,000 respectively.

Better, faster, and cheaper are the bases of increased productivity.

2. Robots will be interacting more directly with the general public. The fast-food industry is a good example. People may be accustomed to ATMs, but a robotic kiosk that asks, “Do you want fries with that?” will occasion widespread public comment, albeit temporarily.

Comment from displaced fast-food restaurant workers may not be so transient. NBC News recently described a strike by workers in an estimated 150 cities. The workers’ main demand was a $15 minimum wage, but they also called for better working conditions. The protesters, ironically, are speeding up their own unemployment by making themselves expensive and difficult to manage.

Labor costs

Compared to humans, robots are cheaper to employ—partly for natural reasons and partly because of government intervention.

Among the natural costs are training, safety needs, overtime, and personnel problems such as hiring, firing and on-the-job theft. Now, according to Singularity Hub, robots can also be more productive in certain roles. They “can make a burger in 10 seconds (360/hr). Fast yes, but also superior quality. Because the restaurant is free to spend its savings on better ingredients, it can make gourmet burgers at fast food prices.”

Government-imposed costs include minimum-wage laws and mandated benefits, as well as discrimination, liability, and other employment lawsuits. The employment advisory Workforce explained, “Defending a case through discovery and a ruling on a motion for summary judgment can cost an employer between $75,000 and $125,000. If an employer loses summary judgment—which, much more often than not, is the case—the employer can expect to spend a total of $175,000 to $250,000 to take a case to a jury verdict at trial.”

At some point, human labor will make sense only to restaurants that wish to preserve the “personal touch” or to fill a niche.

The underlying message of robotechnophobia

The tech site Motherboard aptly commented, “The coming age of robot workers chiefly reflects a tension that’s been around since the first common lands were enclosed by landowners who declared them private property: that between labour and the owners of capital. The future of labour in the robot age has everything to do with capitalism.”

Ironically, Motherboard points to one critic of capitalism who defended technological advances in production: none other than Karl Marx. He called machines “fixed capital.” The defense occurs in a segment called “The Fragment on Machines” in the unfinished but published manuscript Grundrisse der Kritik der Politischen Ökonomie (Outlines of the Critique of Political Economy).

Marx believed the “variable capital” (workers) dislocated by machines would be freed from the exploitation of their “surplus labor,” the difference between their wages and the selling price of a product, which the capitalist pockets as profit. Machines would benefit “emancipated labour” because capitalists would “employ people upon something not directly and immediately productive, e.g. in the erection of machinery.” The relationship change would revolutionize society and hasten the end of capitalism itself.

Never mind that the idea of “surplus labor” is intellectually bankrupt, technology ended up strengthening capitalism. But Marx was right about one thing: Many workers have been emancipated from soul-deadening, repetitive labor. Many who feared technology did so because they viewed society as static. The free market is the opposite. It is a dynamic, quick-response ecosystem of value. Internet pioneer Vint Cerf argues, “Historically, technology has created more jobs than it destroys and there is no reason to think otherwise in this case.”

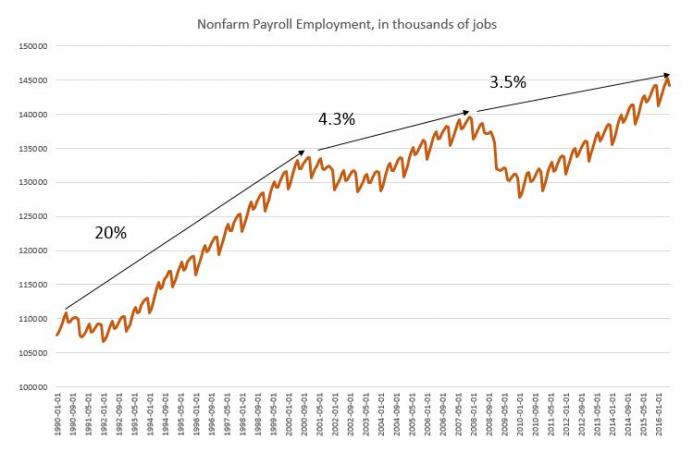

Forbes pointed out that U.S. unemployment rates have changed little over the past 120 years (1890 to 2014) despite massive advances in workplace technology:

There have been three major spikes in unemployment, all caused by financiers, not by engineers: the railroad and bank failures of the Panic of 1893, the bank failures of the Great Depression, and finally the Great Recession of our era, also stemming from bank failures. And each time, once the bankers and policymakers got their houses in order, businesses, engineers, and entrepreneurs restored growth and employment.

The drive to make society static is powerful obstacle to that restored employment. How does society become static? A key word in the answer is “monopoly.” But we should not equivocate on two forms of monopoly.

A monopoly established by aggressive innovation and excellence will dominate only as long as it produces better or less expensive goods than others can. Monopolies created by crony capitalism are entrenched expressions of privilege that serve elite interests. Crony capitalism is the economic arrangement by which business success depends upon having a close relationship with government, including legal privileges.

Restrictive patents are a basic building block of crony capitalism because they grant a business the “right” to exclude competition. Many libertarians deny the legitimacy of any patents. The nineteenth century classical liberal Eugen von Böhm-Bawerk rejected patents on classically Austrian grounds. He called them “legally compulsive relationships of patronage which are based on a vendor’s exclusive right of sale”: in short, a government-granted privilege that violated every man’s right to compete freely. Modern critics of patents include the Austrian economist Murray Rothbard and intellectual property attorney Stephan Kinsella.

Pharmaceuticals and technology are particularly patent-hungry. The extent of the hunger can be gauged by how much money companies spend to protect their intellectual property rights. In 2011, Apple and Google reportedly spent more on patent lawsuits and purchases than on research and development. A New York Times article addressed the costs imposed on tech companies by “patent trolls”—people who do not produce or supply services based on patents they own but use them only to collect licensing fees and legal settlements. “Litigation costs in the United States related to patent assertion entities [trolls],” the article claimed, “totaled nearly $30 billion in 2011, more than four times the costs in 2005.” These costs and associated ones, like patent infringement insurance, harm a society’s productivity by creating stasis and preventing competition.

Dean Baker, co-director of the progressive Center for Economic Policy Research, described the difference between robots produced on the marketplace and robots produced by monopoly. Private producers “won’t directly get rich” because “robots will presumably be relatively cheap to make. After all, we can have robots make them. If the owners of robots get really rich it will be because the government has given them patent monopolies so that they can collect lots of money from anyone who wants to buy or build a robot.” The monopoly “tax” will be passed on to impoverish both consumers and employees.

Conclusion

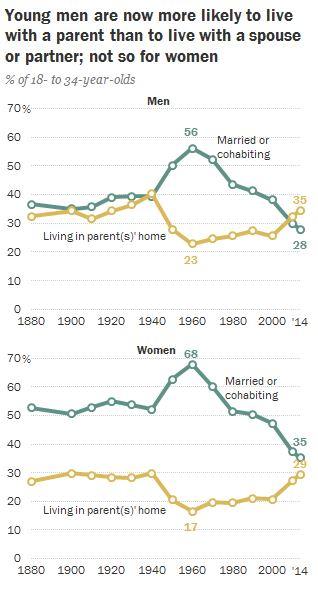

Ultimately, we should return again to the wisdom of Joseph Schumpeter, who reminds us that technological progress, while it can change the patterns of production, tends to free up resources for new uses, making life better over the long term. In other words, the displacement of workers by robots is just creative destruction in action. Just as the car starter replaced the buggy whip, the robot might replace the burger-flipper. Perhaps the burger-flipper will migrate to a new profession, such as caring for an elderly person or cleaning homes for busy professionals. But there are always new ways to create value.

An increased use of robots will cause labor dislocation, which will be painful for many workers in the near term. But if market forces are allowed to function, the dislocation will be temporary. And if history is a guide, the replacement jobs will require skills that better express what it means to be human: communication, problem-solving, creation, and caregiving.

Wendy McElroy (wendy@wendymcelroy.com) is an author, editor of ifeminists.com, and Research Fellow at The Independent Institute (independent.org).

This article was originally published by The Foundation for Economic Education.