Lately, I’ve wondered how my neighbor, Sam, affords to buy so much stuff. He appears to have an unlimited budget. When I asked him about this, Sam asked, “Do you think I’m spending too much?”

“That depends,” I said, “How much money do you make?”

“I take home $100,000 a year.”

That surprised me. I would guess that he’s spending more than that. But I tried to be encouraging, “That sounds like plenty of income. With a little planning, you should be able to budget your spending and be financially stable.”

“But my finances are a mess,” Sam replied. “I spend more than I take home. Last year I had to borrow $12,000 just to cover my spending.”

“Well maybe things will be better this year,” I said, hoping that Sam’s spending issues was a one year problem.

“No,” Sam replied. “Actually, in the first three months of this year, I’ve already spent $19,000 more than I’ve made. It looks like my budget deficit this year will be much worse than it was last year.”

Now I was starting to worry. “Have you been borrowing money to cover your spending for a long time?”

“Oh yes. I have a lot of debt. Part of the problem is that I owe myself $150,000.”

I wondered if Sam misspoke, “Wait, wait, wait, you owe yourself $150,000? Why do you think that you’re in debt to yourself?”

“Well you see, over the years I promised myself that I was going to use my paychecks to pay for a fund for my children’s education, but instead of spending $150,000 on colleges, I spent the money on other expenses. So I figure that I owe myself this money so that I can pay for my children’s college tuitions.”

Obviously Sam doesn’t understand the definition of the word “debt.”

I tried to be polite in my response: “That doesn’t make any sense. It’s true that you’ve made some horrible decisions regarding your spending, but it’s ridiculous to claim that you owe yourself money. A debt occurs when one person owes another person money. Just because you changed your mind about how to spend your paychecks doesn’t mean that you’ve borrowed money from yourself.

“So the first thing you need to do is to think clearly about the amount of debt you have. You don’t owe yourself any money. Now, forgetting about this ridiculous notion of self-debt, how much do you owe?”

“Alright, I think I see your point. Let’s just talk about the rest of my debt. I owe various banks about $420,000. This debt is more than four times my take-home income.”

Sam often lies about his income and spending issues, but he always understates his budget problem. If he’s lying now, then I can be sure that the problem is even greater than he says. I wanted more information.

“That a pretty high debt to income ratio. But that might be somewhat manageable, although unwise, if you’ve borrowed that money at low interest rates.”

“I have some good news and some bad news,” Sam said. “Interest rates are low. In fact, in the last fourteen years, my debt has more than quadrupled, but my interest payments have increased less than 50 percent. That’s because interest rates have collapsed during that time. Isn’t that good news?”

“I suppose, but do you know that interest rates are going to increase over the next several years?”

“Yes, that’s the bad news. In the past year, I only paid $7,000 of interest, but within ten years my debt will increase over 50 percent, and possibly much more, and with higher interest rates I expect to be paying at least four to five times that much in interest annually.”

“That’s a huge problem. So to be able to make your loan payments, I assume that you’ve taken out some long-term loans.”

“No, no, no. In order to take advantage of the low interest rates, most of my borrowing is short term. I rollover my loans quickly. In the past year my principal payments on these loans totaled $207,000.”

“Let me get this straight. Your loan payments, including principal and interest, are well over twice your take home pay?”

“Yes, I take home a little over $8,000 per month and my loan payments are over $17,000 per month. But it’s no problem. In the past year I borrowed $223,000 to cover everything.”

Shocked, I said “How can you say borrowing more than twice your income is not a problem?”

“I simply borrow all the money I need to make all of my loan payments. I never pay any of the loans down. I’ve been doing this for years, ever since I started spending more than I make.”

“Okay. Most of your borrowing goes to cover your increasingly large principal and interest payments. And as interest rates rise, interest payments will become a bigger percentage of your spending. When that happens, your total debt will increase faster than your income. What is your plan, say in the next ten years, to correct this situation?”

“Well I don’t have a plan for correcting anything, because I don’t see how I can cut my spending.”

“What if the banks stop loaning you money to make your payments on your loans? What happens then?”

“I guess I’m assuming that won’t happen.”

Sam’s Budget Situation in Real Numbers

If one of our neighbors budgeted in this manner, we would obviously conclude that the guy is crazy. No such plan could work. Eventually lenders would refuse to fund Sam’s spending.

However, Sam’s situation looks a lot like the federal government budget plan. Take a look at some recent federal budget information and some Congressional Budget Office projections:

- In FY (fiscal year) 2015, the feds had a budget deficit, counting only debt held by the public, of $339 billion, which is about 10 percent of their tax revenues of $3,248 billion. The deficit has been declining the last few years, but that is now changing.

- In fact, in the first three months of FY 2016, according to the Treasury Department, federal debt held by the public increased $548 billion. Admittedly, some of this debt was due to the fact that the feds were cooking the books in FY 2015 when they hit the debt ceiling limit. Nonetheless, the first quarter 2016 deficit is already 60 percent larger than the overall 2015 deficit.

- The federal government claims to owe itself over $5 trillion (they call it intragovernmental debt here). This $5 trillion represents tax revenues that were earmarked for specific spending programs, such as Social Security, but were spent on other programs. Since the feds collected taxes to pay for Social Security, but spent the money on something else, they conclude that they owe it to themselves to collect those tax revenues again. That’s the essence of intragovernmental debt. We should not count this as debt. Give the Treasury Department credit for ignoring this type of “debt” in their Daily Treasury Statements and in their end of the year debt reports.

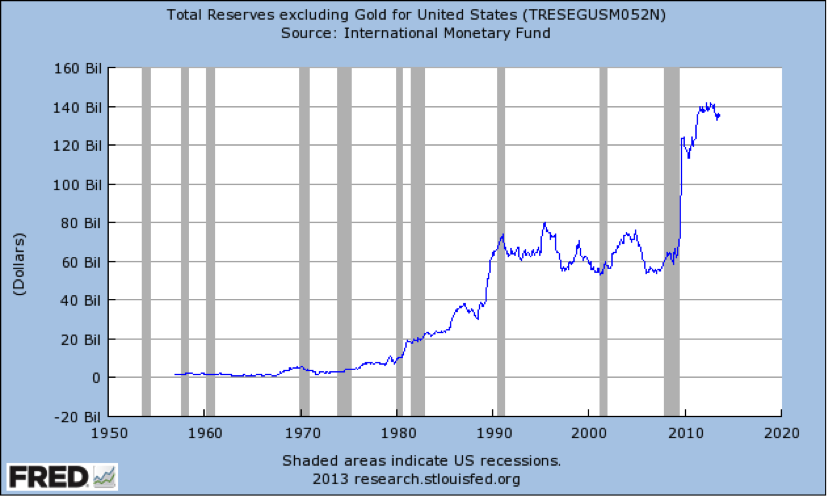

- As of September 30, 2015, the feds had $13.1 trillion of debt owed to the public. FY 2015 tax revenues totaled $3.248 trillion. So just like Sam the government has a 4-to-1 debt-to-tax-revenue ratio.

- In the past fourteen years, from September 30, 2001 (the start of George Bush’s first budget) to September 30, 2015 (the end of Barack Obama’s sixth budget), debt owed to the public increased from $3,339.3 billion to $13,123.8 billion. That’s an increase of 293 percent.

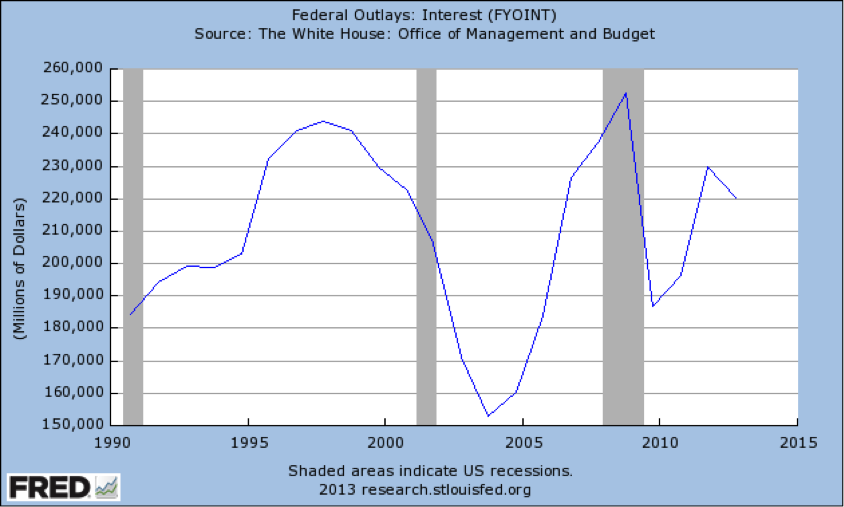

- According to the Daily Treasury Statements, in the past fourteen years, interest on treasury securities increased from $162.5 billion in fiscal year 2001 to $233.1 billion in fiscal year 2015. That’s a 44 percent increase during the same period when federal debt owed to the public almost quadrupled.

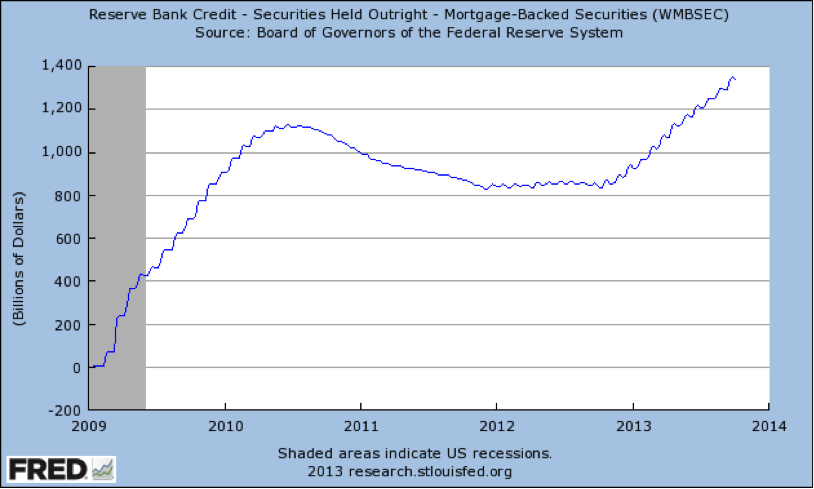

- In FY 2015, again according to the Daily Treasury Statements, the feds borrowed $7,251.4 billion (see the Public Debt Cash Issues for September 30, 2015), an average of almost $20 billion per day. They spent $6,740.3 billion of this borrowing rolling over their debt. So, Federal principal and interest payments are more than double federal tax revenues.

- According to the Congressional Budget Office’s baseline projections, debt held by the public in 2025 should exceed $21 trillion and during that time interest rates are expected to increase. Interest rates have been kept artificially low for years. If interest rates return to a more normal level, say to the rates they were paying when George Bush took office fifteen years ago, then interest payments in 2025 will exceed $1.2 trillion. That’s over a 400 percent increase compared to the FY 2015 interest payments. I should note here that the baseline budget projections are optimistic. We should expect the debt situation in 2025 to be significantly worse than these projections.

The federal government’s debt has exploded under the Bush and Obama administrations. Low interest payments due to the low interest rates have masked their budget problems. As interest rates and the spending gap on entitlement programs such as Social Security both increase, the budget problem will compound.

The federal government’s plan is to borrow all of the money they need to pay all of their principal and interest payments and to also pay for the budget deficits in their spending programs. The question we should ask is: what’s going to happen when the world’s lenders refuse to bankroll DC’s spending schemes?

Mark Brandly is a professor of economics at Ferris State University and an adjunct scholar of the Ludwig von Mises Institute.

This article was published on Mises.org and may be freely distributed, subject to a Creative Commons Attribution United States License, which requires that credit be given to the author.