Contemporary formal schooling inculcates a counterproductive and often stressful fallacy into millions of young people – particularly the best and brightest. The fallacy, which undermines the lives of many, is that, when it comes to learning, productivity, and achievement, you have to get it absolutely right the first time. Consider how grades are assigned in school. You complete an assignment or sit for a test – and if your work product is deficient in the teacher’s eyes, or you answer some questions incorrectly, your grade suffers. It does not matter if you learn from your mistakes afterward; the grade cannot be undone. The best you can do is hope that, on future assignments and tests, you do well enough that your average grade will remain sufficiently high. If it does not – if it takes you longer than usual to learn the material – then a poor grade will be a permanent blot on your academic record, if you care about such records. If you are below the age of majority and prohibited from owning substantial property or working for a living, grades may be a major measure of achievement in your eyes. Too many hits to your grades might discourage you or lead you to think that your future prospects are not as bright as you would wish.

***

But this is not how the real world works. This is not how learning works. This is not how great achievements are attained. It took me years to figure this out. I was one of those students who insisted on always attaining the highest grades in everything. I graduated first in my class in high school (while taking honors and Advanced Placement courses whenever they were offered) and second in college – with three majors. In high school especially, I sometimes found the grading criteria to be rather arbitrary and subjective, but I spent considerable time preparing my work and myself to meet them. While I did engage in prolific learning during my high-school years, the majority of that learning occurred outside the scope of my classes and was the result of self-study using books and the Internet. Unfortunately, my autonomous learning endeavors needed to be crammed into the precious little free time I had, because most of my time was occupied by attempting to conform my schoolwork to the demanding and often unforgiving expectations that needed to be met in order to earn the highest grades. I succeeded at that – but only through living by a regimen that would have been unsustainable in the long term: little sleep, little leisure, constant tension, and apprehension about the possibility of a single academic misstep. Yet now I realize that, whether I had succeeded or failed at the game of perfect grades, my post-academic achievements would have probably been unaffected.

***

How does real learning occur? It is not an all-or-nothing game. It is not about trying some task once and advancing if you succeed, or being shamed and despondent if you do not. Real learning is an iterative process. By a multitude of repetitions and attempts – each aiming to master the subject or make progress on a goal – one gradually learns what works and what does not, what is true and what is false. In many areas of life, the first principles are not immediately apparent or even known by anybody. The solution to a problem in those areas, instead of emerging by a straightforward (if sometimes time-consuming) deductive process from those first principles, can only be arrived at by induction, trial and error, and periodic adjustment to changing circumstances. Failure is an expected part of learning how to approach these areas, and no learning would occur in them if every failure were punished with either material deprivation or social condemnation.

***

Of course, not all failures are of the same sort. A failure to solve a math problem, while heavily penalized in school, is not at all detrimental in the real world. If you need to solve the problem, you just try, try again – as long as you recognize the difference between success and failure and have the free time and material comfort to make the attempts. On the other hand, a failure to yield to oncoming traffic when making a left turn could be irreversible and devastating. The key in approaching failure is to distinguish between safe failure and dangerous failure. A safe failure is one that allows numerous other iterations to get to the correct answer, behavior, or goal. A dangerous failure is one that closes doors, removes opportunities, and – worst of all – damages life. Learning occurs best when you can fail hundreds, even thousands, of times in rapid succession – at no harm or minimal harm to yourself and others. In such situations, failure is to be welcomed as a step along the way to success. On the other hand, if a failure can take away years of your life – either by shortening your life or wasting colossal amounts of time – then the very approach that might result in the failure should be avoided, unless there is no other way to achieve comparable goals. As a general principle, it is not the possibility of success or failure one should evaluate when choosing one’s pursuits, but rather the consequences of failure if it occurs.

***

Many contemporary societal institutions, unfortunately, are structured in a manner hostile to iterative learning. They rather encourage “all-in” investment into one or a few lines of endeavor – with uncertain success and devastating material and emotional consequences of failure. These institutions do not give second chances, except at considerable cost, and sometimes do not even give first chances because of protectionist barriers to entry. Higher education especially is pervaded by this problem.

***

At a cost of tens of thousands of dollars per year, college is an enormous bet. Many think that, by choosing the right major and the right courses of study within it, they could greatly increase their future earning potential. For some, this works out – though they are a diminishing fraction of college students. If a major turns out not to be remunerative, there may be some satisfaction from having learned the material, and this may be fine – as long as it is understood that this is a costly satisfaction indeed. Some will switch majors during their time in college, but this is often in itself an extremely expensive decision, as it prolongs the time over which one must pay tuition. For those who can afford either non-remunerative or serial college majors out of pocket, there is the opportunity cost of their time – but that is not the worst that can happen.

***

The worst fate certainly befalls those who finance their college education through student debt. This was a fate I happily avoided. I graduated college without having undertaken a penny of debt – ever – largely as a result of merit scholarships (and my choice of an institution that gave merit scholarships – a rarity these days). Millions of my contemporaries, however, are not so fortunate. For years hereafter, they will bear a recurring financial burden that will restrict their opportunities and push them along certain often stressful and unsustainable paths in life.

***

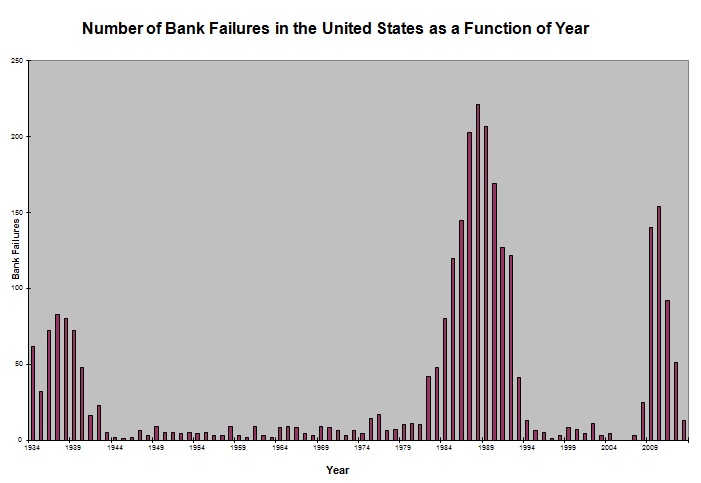

Student debt is the great disruptor of iterative learning. Such debt is assumed on the basis of the tremendously failure-prone expectation of a certain future monetary return capable of paying off the debt. Especially in post-2008 Western economies, this expectation is unfounded – no matter who one is or how knowledgeable, accomplished, or productive one might be. Well-paying jobs are hard to come by; well-paying jobs in one’s own field of study are even scarcer. The field narrows further when one considers that employment should not only be remunerative, but also accompanied by decent working conditions and compatible with a comfortable standard of living that reflects one’s values and goals.

Money is ultimately a means to life, not an end for its own sake. To pursue work that requires constant privation in other areas of life is not optimal, to say the least – but debt leaves one with no choice. There is no escape from student debt. Bankruptcy cannot annul it. One must keep paying it, to avoid being overwhelmed by the accumulated interest. Paying it off takes years for most, decades for some. By the time it is paid off (if it is), a lot of youth, energy, and vitality are lost. It follows some to the grave. If one pays it off as fast as possible, then one might still enjoy a sliver of that precious time window between formal education and senescence – but the intense rush and effort needed to achieve this goal limits one’s options for experimenting with how to solve problems, engage in creative achievement, and explore diverse avenues for material gain.

***

If you are in heavy debt, you take what income you can get, and you do not complain; you put all of your energy into one career path, one field, one narrow facet of existence – in the hope that the immediate returns are enough to get by and the long-term returns will be greater. If you wish to practice law or medicine, or obtain a PhD, your reliance on this mode of living and its hoped-for ultimate consequences is even greater. You may defer the payoff of the debt for a bit, but the ultimate burden will be even greater. Many lawyers do not start to have positive financial net worth until their thirties; many doctors do not reach this condition until their forties – and this is the reality for those who graduated before the financial crisis and its widespread unemployment fallout. The prospects of today’s young people are even dimmer, and perhaps the very expectation of long-term financial reward arising from educational debt (or any years-long expensive formal education) is no longer realistic. This mode of life is not only stressful and uncertain; it comes at the expense of family relationships, material comfort, leisure time, and experimentation with diverse income streams. Moreover, any serious illness, accident, or other life crisis can derail the expectation of a steady income and therefore render the debt a true destroyer of life. Failure is costly indeed on this conventional track of post-undergraduate formal schooling.

***

It may be difficult for many to understand that the conventionally perceived pathway to success is in fact one that exposes a person to the most dangerous sorts of failure. The best way forward is one of sustainable iterative work – a way that offers incremental benefits in the present without relying on huge payoffs in the future, all the while allowing enough time and comfort to experiment with life-improving possibilities at one’s discretion. Diversification is the natural companion of iteration. The more you try, the more you experiment, the more you learn and the more you can apply in a variety of contexts.

***

Having avoided the student-debt trap, I can personally attest to how liberating the experience of post-academic learning can be. Instead of pursuing graduate or professional school, I decided to take actuarial and other insurance-related examinations, where the cost of each exam is modest compared to a semester of college – and one can always try again if one fails. In the 3.5 years after graduating from college, I was able to obtain seven professional insurance designations, at a net profit to myself. I have ample time to try for more designations still. My employment offers me the opportunity to engage in creative work in a variety of capacities, and I focus on maximizing my rate of productivity on the job so as to achieve the benefits of iterative learning and avoid the stress of an accumulated workload. I could choose where I wanted to live, and had the resources to purchase a house with a sizable down payment. Other than a mortgage, which I am paying ahead of schedule, I have no debt of any sort. Even the mortgage makes me somewhat uncomfortable – hence my desire to pay it off as rapidly as possible – but every payment gets me closer to fully owning a large, tangible asset that I use every day. In the meantime, I already have a decent amount of time for leisure, exercise, independent study, intellectual activism, and family interactions.

***

My life, no doubt, has its own challenges and stresses; anyone’s situation could be better, and I can certainly conceive of improvements for my own – but I have the discretionary time needed to plan for and pursue such improvements. Moreover, the way of iterative learning is not fully realizable in all aspects of today’s world. Comparatively, I have fewer vulnerabilities than debt-ridden post-undergraduate students of my age, but I am not immune to the ubiquitous stressors of contemporary life. We continue to be surrounded by dangers and tasks where it is truly necessary not to fail the first time. As technology advances and we come to life in a safer, healthier world, the sources for life-threatening failure will diminish, and the realm of beneficial trial-and-error failure will broaden. The key in the meantime is to keep the failure points in one’s own life to a minimum. Yes, automobile accidents, crime, and serious illnesses always have a non-zero probability of damaging one’s life – but even that probability can be diminished through vigilance, care, and technology. To avoid introducing vulnerability into one’s life, one should always live within one’s present means – not expectations of future income – and leave oneself with a margin of time and flexibility for the achievement of any goal, financial or not. Productivity, efficiency, and skill are all welcome assets, if they are used to prevent, rather than invite, stress, anxiety, and physical discomfort.

***

Learning absolutely anything of interest and value is desirable, as long as the cost in time and money – including the opportunity cost – is known and can be absorbed using present resources. This principle applies to any kind of formal schooling – or to the purchase of cars, major articles of furniture, and electronic equipment. If you enjoy it, can afford it out of pocket, and can think of no better way to use your time and money – then by all means pursue it with a clear conscience. If you cannot afford it, or you need the money for something more important, then wait until you have the means, and find other ways to use and enjoy your time in the interim. With the Internet, it is possible to learn many skills and concepts at no monetary cost at all. It is also possible to pursue relatively low-cost professional designation programs in fields where sitting in a classroom is not a requirement for entry.

***

Remember that success is attained through many iterations of a variety of endeavors. Try to make each iteration as inexpensive as possible in terms of time and money. Except in times of acute crisis where there are no other options, avoid all forms of debt – with the possible exception of a mortgage, since it is preferable to the alternative of renting and giving all of the rent away to another party. Do not put all of your time and energy into a single field, a single path, a single expectation. You are a multifaceted human being, and your job in life is to develop a functional approach to the totality of existence – not just one sub-specialty therein. Remember, above all, never to lose your individuality, favored way of living, and constructive relationships with others in the pursuit of any educational or career path. You should be the master of your work and learning – not the other way around.