Understanding Bitcoin requires that we understand the limits of our ability to imagine the future that the market can create for us.

Thirty years ago, for example, if someone had said that electronic text—digits flying through the air and landing in personalized inboxes owned by us all that we check at will at any time of the day or night—would eventually displace first class mail, you might have said it was impossible.

After all, not even the Jetsons cartoon imagined email. Elroy brought notes home from his teacher on pieces of paper. Still, email has largely displaced first-class mail, just as texting, social networking, private messaging, and even digital vmail via voice-over-Internet are replacing the traditional telephone.

It turns out that the future is really hard to imagine, especially when entrepreneurs specialize in surprising us with innovations. The markets are always outsmarting even the most wild-eyed dreamers, and they are certainly smarter than the intellectual who keeps saying: such and such cannot happen.

It’s the same today. What if I suggested that digital money could eventually come to replace government paper money? Heaven knows we need a replacement.

Solving Problems a Byte at a Time

Money started in modern times as gold and silver, and it was controlled by its owners and users. Then the politicians got hold of it—a controlling interest in half of every transaction—and look what they did. Today money is rooted in nothing at all and its value is subject to the whims of central planners, politicians, and monetary bureaucrats. This system is not very modern when we consider a world in which the market is driving innovations in other aspects of our daily lives.

Maybe it was just a matter of time. The practicality is impossible to deny: Gamers needed tokens they could trade. Digital real estate needed to be bought and sold. Money was also becoming more and more notional, with wire transfers, bank computer systems, and card networks serving to move “money” around. The whole world was gradually migrating to the digital sphere, but conventional money was attached to the ground, to vaults owned or controlled by governments.

The geeks went to work on it in the 1990s and developed a number of prototypes—Ecash, bit gold, RPOW, b-money—but they all faltered for the same reason: their supply could not be limited and no one could figure out how to make them impossible to double and triple spend. Normally, reproducibility is a wonderful thing. You can send me an image and still keep it. You can send me a song and not lose control of yours. The Internet made possible infinite copying, which is a great thing for media and texts and—with 3-D printing—even objects. But reproducibility is not a feature that benefits a medium of exchange.

After all, a currency is useless unless it is scarce and its replication is carefully controlled. Think of the gold standard. There is a fixed amount of gold in the world, and it enters into economic life only through hard work and real expenditure. Gold has to be mined. All gold is interchangeable with all other gold, but when I own an ounce, you can’t own it at the same time. How can such a system be replicated in the digital sphere? How can you assign titles to a fungible digital good and makes sure that these titles are absolutely sticky to the property in question?

Follow the Money

Finally it happened. In 2008, a person called “Satoshi Nakamoto” created Bitcoin. He wasn’t the first to solve the problem of double spending. A currency called e-gold did that, but the flaw was that there was a central entity in charge that users had to trust. Bitcoin removed this central point of failure, enabling miners themselves constantly to validate the transaction record. He had each user download the full ledger of all existing Bitcoins so that each could be checked for its title and not used more than once at the same time. With his system, every coin had an owner, and the system could not be gamed.

Further, Nakamoto built in a system of mining that attempts to replicate the experience of the gold standard. The math equations you have to solve get harder over time. The early creators had it easy, just like the early miners of gold could pan it out of the river, though later they had to dig into the mountain. Nakamoto put a limit on the number of coins that can be mined (21 million by 2140). (A new coin is currently mined every 20 seconds or so, and a transaction occurs every second.)

He made his code completely open-source and available to all so that it could be trusted. And the payment system used the most advanced form of encryption, with public keys visible to all and a scrambling system that makes its connection to the private key impossible to discover.

No one would be in charge of the system; everyone would be in charge of the system. This is what it means to be open source, and it’s the same dynamic that has made WordPress a powerhouse in the software community. There would be no need for an Audit Bitcoin movement. Trust, anonymity, speed, strict property rights, and the possibility that applications could be built on top of the infrastructure made it perfect.

Bitcoin went live on November 1, 2008. To really appreciate why this matters, consider the times. The entire political and financial establishment was in full-scale panic meltdown. The real estate markets had collapsed, pulling down the balance sheets of the major banks. The investment banks were unloading mortgage-backed securities at an unprecedented pace. Boats delivering goods couldn’t leave shore because they could find no backers for their insurance bonds. For a moment, it seemed like the world was ending. The Republicans held the White House, but the unthinkable still happened: Government and the central banks decided to attempt a full-scale rescue of the whole system, spending and creating trillions in new paper tickets to fill bank vaults.

Clearly government paper was failing. A digital alternative had to exist. But what gave Bitcoin its value? There were several factors. It was not fixed to any existing currency, so it could float according to human valuation. It was made from real stuff: the very 1s and 0s that were driving forward the global market economy. And while 1s and 0s can be reproduced unto infinity, the new coins could not, thanks to a system in which the coin and its public key were strictly controlled and the ledger updated for every transaction. Its soundness could be checked constantly through instantaneous conversion to other currencies as well as to goods and services. The model seemed impenetrable, the first digital currency that really addressed all the problems that had doomed previous attempts.

A Bitcoin of One’s Own

Let’s fast forward in time to March 2013. I had become the proud owner of my first Bitcoin. My wallet lived on my smartphone. Only three years ago, some wonderful applications had already developed around the currency unit. Although I’m a bit techy, I’m not a rocket scientist and I’m quite certain that I would have been out of my league. But this is how digital institutions develop to become ever more user friendly. At the same event at which I became a Bitcoin owner, I also used a Bitcoin ATM. I put in the green stuff, held my digital wallet up to the scanner, and then I felt the buzz on my smartphone. Physical became digital. Beautiful.

But still I wondered what exactly I could do with these things. That’s when the consumer world of Bitcoin products appeared before me. We aren’t just talking about the Silk Road—a website that became notorious for enabling the easy, anonymous buying and selling of drugs. There are Bitcoin stores everywhere. And there are services in which you can buy from any website with a Bitcoin interface. There was growing talk of Bitcoin futures markets. Some companies were rumored to be going public with Bitcoins, and thereby bypassing the whole of the Securities and Exchange Commission. The implications are mind-blowing.

Sacred Pliers

Still, I’m a tactile kind of guy. I need to experience things. So I went to one of these sites. I brought the first product I saw (why, I do not know). It was a pair of pliers for crimping electric cables. I put in my shipping address and up came a note that said it was time to pay. This was the moment I had been waiting for. A QR code—that funny square design that looks like a 3-D bar code—popped up onscreen. I held up my “wallet” and scanned. In less than 2 seconds, the deed was done. It was easier than Amazon’s one-click ordering system. My heart raced. I jumped out of my chair and did a quick song and dance around the room. Somehow I had seen it thoroughly for the first time: this is the future.

The pliers arrived two days later, and even though I have no use for them, I still treasure them.

Bitcoin had already taken off when the surprising Cyprus crisis hit in a big way. The government was talking about seizing bank deposits as a way of bailing out the whole system. During this period, Bitcoin essentially doubled in value. Press reports said that people were pulling out government currency and converting it, not only in Cyprus but also in Spain and Italy and elsewhere. The price of Bitcoin in terms of dollars soared. Another way to put this is that the price of goods and services in terms of Bitcoin was going down. Yes, this is the much-dreaded system that mainstream economists decry as “deflation.” The famed Keynesian Paul Krugman has even gone so far as to say that the worst thing about Bitcoin is that people hoard them instead of spending them, thereby replicating the feature of the gold standard that he hates the most! He might as well have given a ringing endorsement, as far as I’m concerned.

Obsession and Resentment

My own experience with Bitcoin during this time intensified. I began to call friends on Skype and scan their QR codes and trade currencies. I began to rope other people into the obsession based on my experience: you have to own to believe. After one full day of buying, selling, and using Bitcoins, I had the strange experience of resenting that I had to pay a cab fare in plain old U.S. dollars.

How do you obtain Bitcoins? This process can be a bit tricky. You can look up localbitcoins.com and find a local person to meet you to trade cash for Bitcoins. Usually, this exchange takes place at high premiums of anywhere from 10 percent to 50 percent depending on how competitive the local market is. It is understandable why people are reluctant to do this, no matter how safe it is. There is just something that seems sketchy about meeting a stranger in an all-night cafe to do some unusual digital currency exchange.

A more conventional route is to go to one of many online sellers and link up your bank account and buy. This process can take a few days. And then when you set out to transfer the funds, you might be surprised at the limits in the market that exist these days. Sites are rationing Bitcoin selling based on availability, just given the high demand. It could be 10 days or more to go from non-owner to real owner. But once you have them, you are off to the races. Sending and receiving money has never been easier.

Doubts?

As of this writing, a Bitcoin is trading for $88.249. Just three years ago, it hovered at 0.14 cents. Many people look at the current market and think, surely this is a speculative bubble. That could be true, but it might not be. People are exchanging an unstable, fiat paper for something with a real title that cannot be duplicated. Everyone knows precisely how many Bitcoins exist at any time. Anyone can observe the transactions taking place in real time. A Bitcoin’s price can go up and down, and that’s fine, but there is no real speculation going on here that is endogenous to the Bitcoin market itself.

Is it a pyramid scheme? The defining mark of a pyramid scheme is that more than one person has an equal claim on the same money or good. This is physically impossible with Bitcoin. The way the program is set up, it is a strict property rights regime with no exceptions. In fact, in early March, there was a brief hiccup in the system when some new coins were approved by one group of developers but not approved by another. A “fork” appeared in the system. The price began to fall. Developers worked fast to resolve the dispute and eventually the system—and the price—returned to normal. This is the advantage of the open-source system.

But what about the vague sense some people have that a handful of coders cannot, on their own, cause a new currency to come in existence? Well, if you look back at what Austrian monetary theorist Carl Menger says, he points out that a similar process is precisely how gold became money. Every new currency is not at first used by everyone. It is at first used only “by the most discerning and most capable economizing individuals.” Their successful behaviors are then emulated by others. In other words, the emergence of money involves entrepreneurship—that is, being alert to opportunities to discover and provide something new.

Leviathan Leers

But what about a government crackdown? No doubt that attempt will be made. Already, some national government agencies are expressing some degree of annoyance at what could be. But governments haven’t been able to control the cash economy. It would be infinitely more difficult to control a virtual currency with no central bank, with encryption, and with millions of users per day. Controlling that would be unthinkable.

There was a time when the idea that ebooks would replace physical books was an absurd notion. When I first took a look at the early generation of ereaders, I laughed and scoffed. It will never happen. Now I find myself looking for a home for my physical books and loading up on ebooks by the hundreds. Such is the way markets surprise us. Technology without central planners makes dreams come true.

It’s possible that Bitcoin will flop. Maybe it is just the first generation. Maybe thousands of people will lose their shirts in this first go-round. But is the digitization of money coming? Absolutely. Will there always be skeptics out there? Absolutely. But in this case, they are not in charge. Markets will do what they do, building the future whether we approve or understand it fully or not. The future will not be stopped.

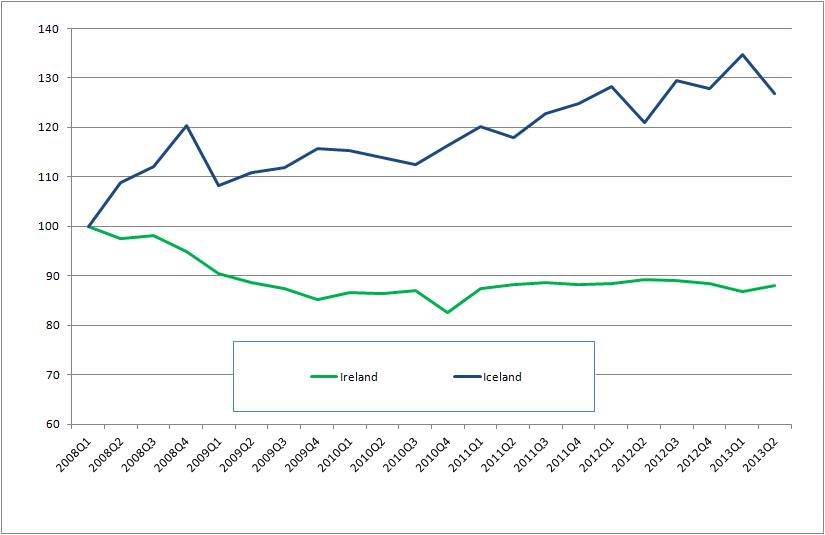

Figure 1: Nominal GDP (2008 = 100) Source: Federal Reserve Bank of St. Louis

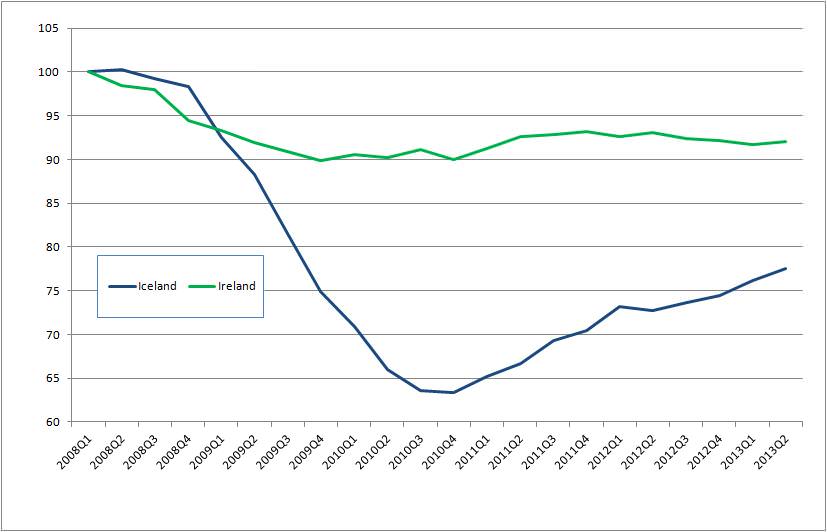

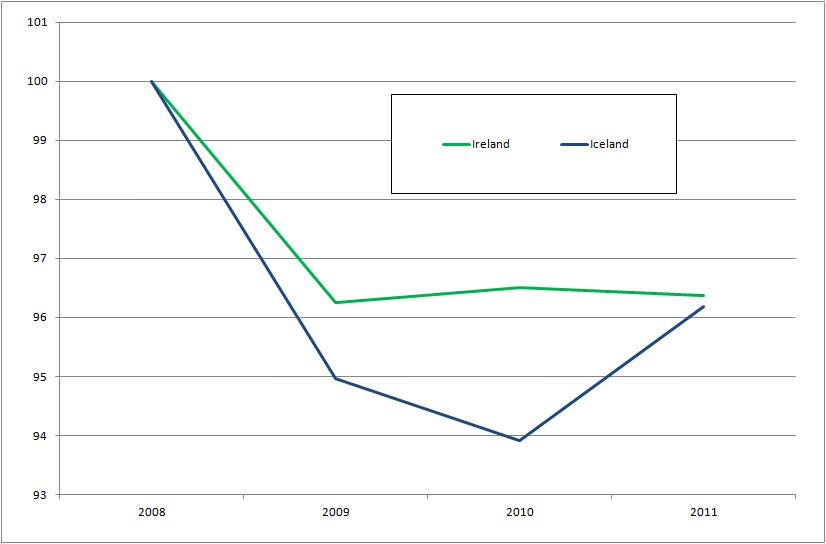

Figure 1: Nominal GDP (2008 = 100) Source: Federal Reserve Bank of St. Louis Figure 2: Real GDP (2008 = 100) Source: Federal Reserve Bank of St. Louis

Figure 2: Real GDP (2008 = 100) Source: Federal Reserve Bank of St. Louis Figure 3: Employment rate (2008 = 1) Source: Federal Reserve Bank of St. Louis

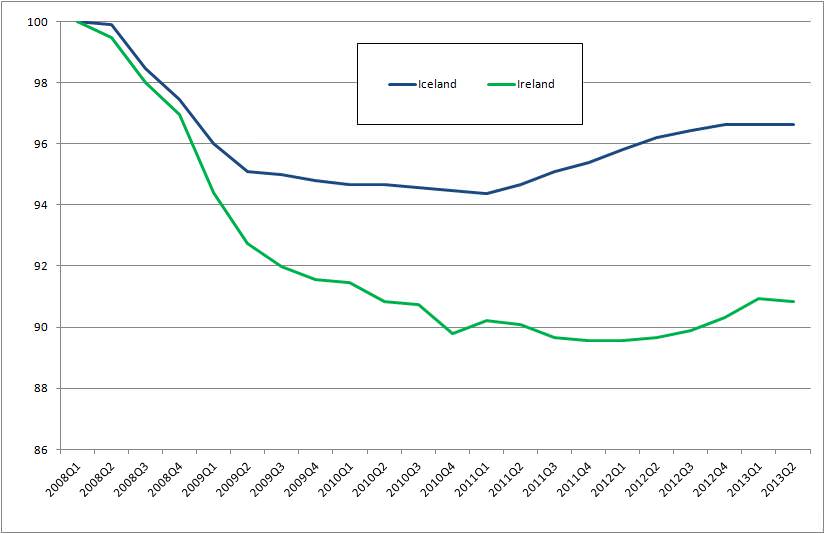

Figure 3: Employment rate (2008 = 1) Source: Federal Reserve Bank of St. Louis Figure 4: Annual hours worked (2008 = 100) Source: Federal Reserve Bank of St. Louis

Figure 4: Annual hours worked (2008 = 100) Source: Federal Reserve Bank of St. Louis