A Plan to Make Me Great Again – Article by Jeffrey Tucker

I was out shopping for a sweater this weekend and I ran into Donald Trump, who told me that I should stop outsourcing my job.

“You should be knitting your own sweaters.”

I explained that I’m not very good at knitting. I have other things to do, in any case. This whole idea strikes me as a huge waste of time. I just can’t see myself sitting at home doing knitting. It’s true that this would give me a job, but it is not a job I want, especially since someone else wants to do it for me.

But he strongly disagreed, explaining that the problem with this country is that we keep taking away our own jobs and keep giving them to other people, who then get the money. This is a bad thing. This is why we are all suffering so much.

I persisted with objections, so he proposed a deal. If I continue to outsource my job, I will have to pay him a 35% tax, which means that if I spend $50 on a sweater, I will need to send him $17.50. That’s a bummer, we both agreed.

Instead, he said, if I take up sweater knitting, he will reduce my income tax rate to a flat 15%, plus exempt my sweater-making from all existing regulations. I would be free to make any sweater I want. The catch is that I have to knit sweaters, because doing that will make me great.

“Just think of it,” he said, “Jeffrey Tucker is open for business!”

In some ways, this sounds pretty sweet. A bit goofy but OK. It’s awkward but I’ll take up knitting on nights and weekends, producing at least one sweater per month. I will continue to do this in order to earn the promised benefit.

Also, I’ll stop buying sweaters at the store and thus end my addiction to outsourcing my production. It’s true that I have given up a huge amount of my freedom over how I spend my time and use my resources (I have to buy all those yarns and needles), but, on the plus side, I avoid a punishing penalty, pay lower taxes, and obey fewer regulations.

The deal doesn’t strike me as very efficient, but, as Trump said, this focus on efficiency over greatness is precisely what has gone wrong in this country.

Sometimes I wonder why his version of greatness should prevail over mine, but, hey, he is the President.

One Month Later

I finally finished my first sweater, and I’m a bit behind on other things. I gave up my job driving Uber. I stopped selling stuff on eBay. I was doing volunteer work for a local charity and I had to give that up too. But at least now I have a sweater. Maybe I can make money at this after all.

I tried to sell it but I couldn’t find any buyers. It turns out that everyone else who needed sweaters had made a similar deal. They too had been persuaded to become great by knitting their own sweaters. We had all become sweater-self-sufficient.

I hope they aren’t feeling as poor as I feel now.

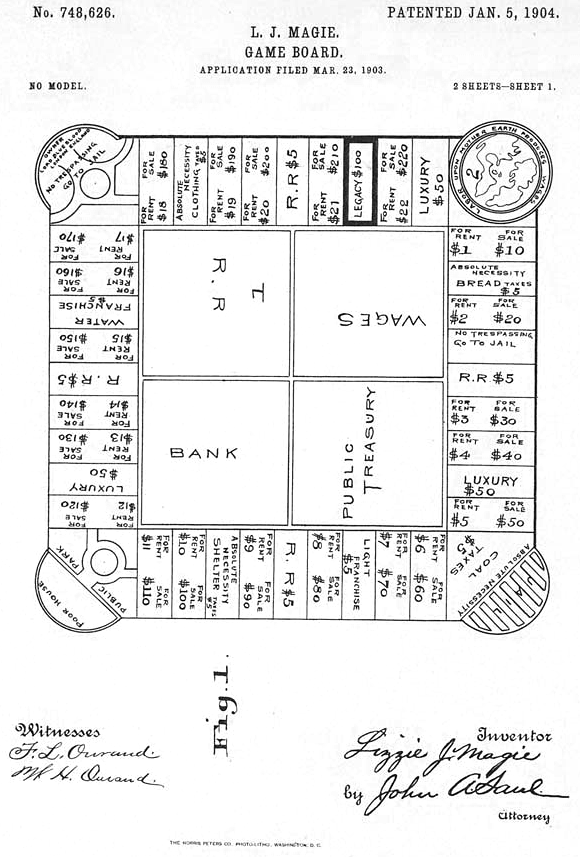

I gradually came to realize something. If you cooperate with others, share the work, find out what you do best, trade with others, and make your own decisions about what you want to insource versus outsource, you can eventually find the best strategy for using your time and resources well.

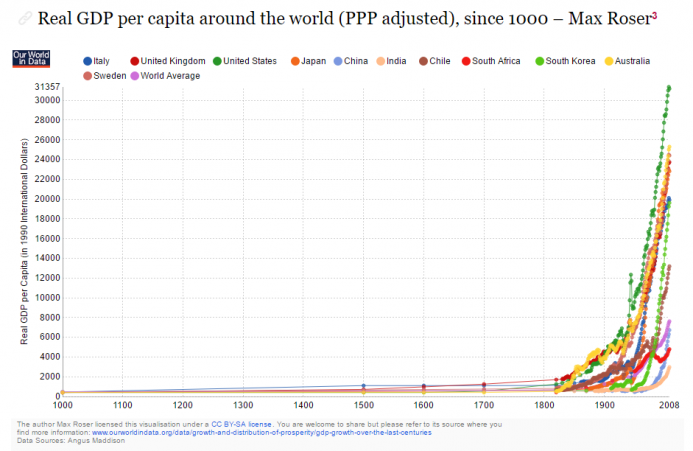

As Adam Smith proved so long ago, a key to prosperity is the expansion of the division of labor, that is, finding ways to benefit from the talents of others wherever they happen to be. I can only do this if I am truly free to buy and sell based on my own evaluation of what benefits me the most. And under this system, what benefits me also happens to benefit everyone.

This system, which we can call free trade, has the added benefit of creating a kind of community feeling. Peace. Prosperity. There is something great about that after all.

Jeffrey Tucker

Jeffrey Tucker is Director of Content for the Foundation for Economic Education and CLO of the startup Liberty.me. Author of five books, and many thousands of articles, he speaks at FEE summer seminars and other events. His latest book is Bit by Bit: How P2P Is Freeing the World. Follow on Twitter and Like on Facebook. Email.

This article was originally published on FEE.org. Read the original article.