Actually, “Neoliberalism” Is Awesome – Article by Scott Sumner

Unfortunately, What’s Best for the World Is Not Best for Every Subset of It

I am seeing more and more articles, even at respectable outlets such as the Economist and the Financial Times, suggesting that the rise of right-wing and left-wing populism shows that something is wrong with the neoliberal model.

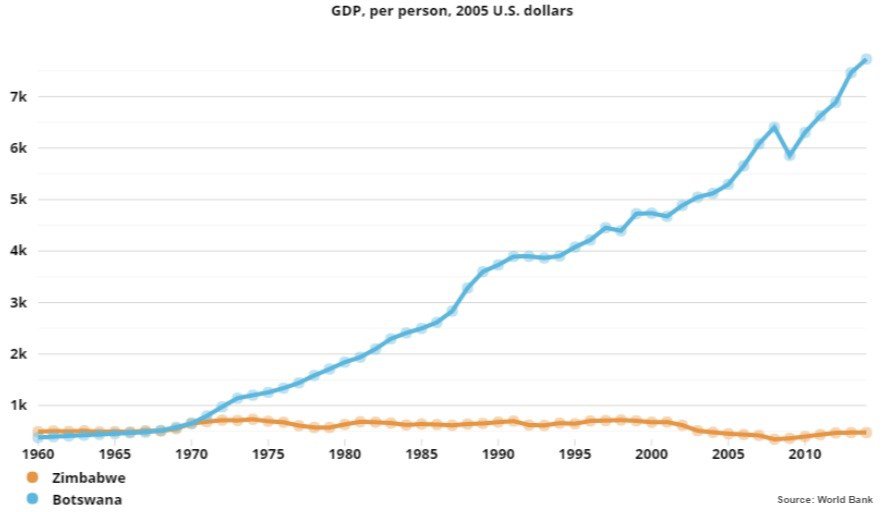

Nothing could be further from the truth. The past two decades have been by far the best two decades in human history, and that’s what really matters.

Naysayers will sometimes acknowledge that hundreds of millions of people have recently risen out of poverty, but then claim that living standards have stagnated in America. That’s also nonsense, as I explained in this post.

The next fallback position is that while real incomes in America have risen, the gains have gone to corporations, not workers. That’s also nonsense, as I explained in this post. The share of national income going to workers today is the same as it was 50 years ago, the supposed heyday of the working class.

The next fallback position is that while wages have done fine, even in real terms, wage income is becoming less equal. Bingo! Finally we get to an accurate statement. Fifty years ago, blue-collar workers at General Motors often made more than college professors. People with short attention spans sometimes act like this period was “normal”, ignoring 10,000 years of human history. They seem to suggest that our most pressing problem is that young men who don’t study in school and just shoot rubber bands across the classroom should be able to earn an income that (in relative terms) was never possible in any period of world history before the 1950s and has never been possible in any period of world history after the 1970s. It reminds me of when farmers used to set the “parity” of farm prices with other goods prices based on the relatively high levels of 1909-14, treating that ratio as normal for purposes of farm subsidies.

Don’t get me wrong: I have nothing against blue-collar workers. I’m relatively intellectual, and even I found the public schools to be mind-numbingly boring. I could hardly stay awake. I can’t even imagine how students less interested in ideas than I am could’ve gotten through the day. Nor am I one of those conservatives that will trash low-income whites for their lifestyle choices. As far as blue-collar workers are concerned, I wish them well. But I wish everyone well (except Trump), and the unfortunate truth is that the set of economic policies that is best for the world right now is probably not optimal for a subset of American blue-collar workers.

When I point out that the most important factor in trade policy is the impact on the poor in developing countries, some of my commenters tell me that the US shouldn’t have to import from China or India because they have lots of other countries to sell to. As Marie Antoinette might’ve said “let them sell to Canada.” That’s right, progressives ease their conscience by claiming that other developed countries won’t follow the same evil trade policies that progressives like Sanders want the US to follow, so things won’t actually be that bad for poor people in Bangladesh. More often, they entirely ignore the issue.

I know that progressives like to think of themselves as the good guys, but the honest truth is that on trade they are increasingly becoming the bad ones, right along with Trump.

And here’s what else people don’t get. Not all the problems in the world are caused by neoliberal economic theories, for the simple reason that not all economic policies reflect neoliberal economic theories. Even if everything people say about inequality is true, there’s nothing wrong with the neoliberal model, which allows for the EITC, progressive consumption taxes, and sensible reforms of intellectual property rights, occupational licensing, and zoning laws.

I can’t help it if Democratic politicians oppose reforms of intellectual property rights. I can’t help it if progressives that once favored progressive consumption taxes now oppose progressive consumption taxes. I can’t help it if Democrats voted to repeal the luxury tax on yachts soon after having enacted a luxury tax on yachts. I can’t help it if progressives suddenly feel that a $15 an hour minimum wage is not a loony idea.

The simple truth is that neoliberal economic policies work, as we’ve seen in Denmark and Switzerland and Singapore, and socialism doesn’t work, as we’ve seen in Venezuela. So I’m asking all those wavering neoliberals in the respectable press (Thatcher called them “wets“) to stop your handwringing and get out there and boldly defend the neoliberal model. It’s not just the best model; in the long run it’s the only model that really works.

Scott B. Sumner is the director of the Program on Monetary Policy at the Mercatus Center and a professor at Bentley University. He blogs at the Money Illusion and Econlog.

This article was originally published by The Foundation for Economic Education and may be freely distributed, subject to a Creative Commons Attribution 4.0 International License, which requires that credit be given to the author.